In the whirlwind that is today’s business landscape, staying ahead of the game is crucial for growth and revenue. It’s our position that it simply can’t be done without the skills of a Chief Revenue Officer. But that kind of financial obligation can be steep for small to mid-size enterprises. So, meet the Fractional CRO—your secret weapon for top-tier revenue strategies without the full-time baggage. Buckle up as we dive into the dynamic world of Chief Revenue Officers (CROs) and uncover their indispensable role in propelling your business to new heights.

A CRO oversees all things revenue including marketing, sales, customer success and sometimes product development

What does a Chief Revenue Officer do?

A Chief Revenue Officer (CRO) plays a pivotal role in any organization, standing at the intersection of marketing, sales, and customer success. The chief revenue officer job description typically includes overseeing all revenue-generating processes and ensuring alignment across these departments. If it has to do with revenue, the CRO is at the helm. From developing robust sales strategies to fostering strong client relationships, CROs are instrumental in driving revenue growth. Therefore, it’s no surprise that chief revenue officer jobs** have become highly sought-after in recent years. “Hiring a fractional CRO allows companies to implement high-level revenue strategies and improve key metrics without permanently expanding the executive payroll.”

**Source:** https://www.forbes.com/sites/forbestechcouncil/2020/11/12/the-rise-of-the-fractional-executive/?sh=58f3ab2c1d4e

What level is a Chief Revenue Officer?

A Chief Revenue Officer sits at the C-Suite executive level within an organization. As such, they hold significant influence and responsibility, working closely with other C-suite executives to shape the company’s overall strategy. The CRO’s primary objective is to unify various teams under a cohesive revenue strategy, ensuring every department’s efforts culminate in achieving the company’s financial goals. Continuity is the primary goal whether it’s a full-time or fractional CRO.

What are the qualifications of a CRO?

A Fractional CRO has multiple tools and skill sets at their disposal

When examining the chief revenue officer job description, it’s clear that a CRO must possess a diverse skill set. Typically, they hold advanced degrees in business, marketing, or a related field, combined with extensive industry experience. Many CROs have backgrounds in sales leadership or have undergone specific chief revenue officer training designed to equip them with the knowledge to excel in this role. This training often includes in-depth coursework on revenue optimization, financial forecasting, and strategic planning.

Chief Revenue Officers (CROs) typically have extensive sales experience, often amounting to 10-20 years in various high-level sales roles before ascending to the CRO position. In fact, 76% of all CRO’s have 15 years+ of in-depth sales experience. This depth of experience equips them with a nuanced understanding of sales strategies, customer behavior, and market dynamics, enabling them to drive revenue effectively across multiple departments. They are adept at identifying opportunities, mitigating risks, and leading diverse teams towards unified revenue goals.

Do you need a degree to be a CRO?

While there is no strict requirement for CROs to hold a specific degree, most Chief Revenue Officers typically possess at least a bachelor’s degree in fields such as business, marketing, or finance. Additionally, many CROs bolster their educational credentials with advanced degrees like an MBA, which can provide deeper knowledge in strategic management and business operations.

However, what’s often more critical than formal education is the breadth of experience and proven track record in sales, marketing, and leadership roles. CROs are expected to bring extensive industry experience, comprehensive revenue strategies, and exceptional leadership skills to the table, which are cultivated over years of hands-on work rather than solely through academic qualifications.

In essence, while a degree can enhance a candidate’s profile, the combination of experience, strategic insight, and a knack for driving growth is what truly defines a successful CRO. Ultimately, it’s all about the revenue numbers. Forbes says that bringing on a fractional CRO results in an average of 33% revenue growth. Furthermore, “Fractional CROs can reduce the time to market by up to 28%, speeding up critical revenue-generating initiatives and improving overall business agility.”

**Source:** https://www.inc.com/resource-guide/benefits-of-hiring-fractional-cro

What skills do you need to be a Chief Revenue Officer?

“A Fractional CRO brings top-notch sales and marketing expertise without the full-time commitment.”

To thrive as a Chief Revenue Officer, individuals must demonstrate a blend of analytical acumen and interpersonal skills. Key competencies include:

Strategic thinking: Crafting and implementing long-term plans to achieve revenue targets.

Leadership: Motivating and managing sales, marketing, and customer success teams.

Analytical skills: Interpreting data to make informed decisions and drive growth.

Communication: Clearly conveying ideas and strategies to stakeholders at all levels.

Marketing skills also enhance a CRO’s ability to communicate and collaborate with the marketing team. Understanding the language and metrics of marketing allows the CRO to provide clear direction, set realistic expectations, and achieve cohesive execution of cross-functional initiatives.

The marketing landscape is ever-evolving with new technologies, platforms, and trends. So adaptability is key. A CRO skilled in marketing is better equipped to adapt to these changes, ensuring the company stays relevant and ahead of market shifts.

Marketing skills empower a CRO to craft integrated strategies that drive growth, engage customers, and enhance the company’s market position. It’s all about creating a unified approach that capitalizes on every opportunity to boost revenue.

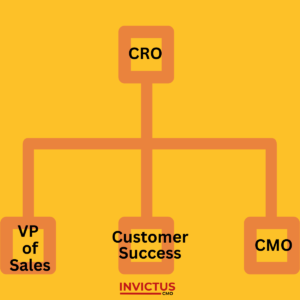

Who reports to a Chief Revenue Officer?

Understanding the reporting structure is crucial for defining the scope of a CRO’s responsibilities. Typically, several key roles report directly to the Chief Revenue Officer, ensuring seamless coordination across all revenue-generating activities. So, who reports to a Chief Revenue Officer? This usually includes:

– Sales Directors or Managers

-VP of Sales

– Marketing Heads

-Chief Marketing Officer

– Customer Success Leaders

– Account Management Teams

Who does a Chief Revenue Officer report to?

CROs report to CEOs

In the organizational hierarchy, the Chief Revenue Officer typically reports to the CEO. This direct reporting line underscores the importance of the CRO’s role in shaping and executing the company’s revenue strategy. It also facilitates close collaboration between the CRO and CEO, ensuring that revenue goals align with the broader company objectives.

What is the highest paid Chief Revenue Officer?

Compensation for Chief Revenue Officers can vary widely depending on factors such as company size, industry, and location. However, the position is generally well-compensated due to its critical importance. According to recent salary surveys.

While specific compensation details for Chief Revenue Officers (CROs) can vary and are not always publicly disclosed, several prominent CROs in well-known companies are recognized for their high-profile roles and likely command significant salaries due to their impact and leadership. Here are a few notable examples:

- Graham Stanton – Peloton

Graham Stanton is known for his role as Chief Revenue Officer at Peloton, the high-flying fitness company. Stanton played a critical role in scaling Peloton’s subscriber base and driving significant revenue growth during his tenure.

- Brian Roberts – Lyft

Brian Roberts served as the Chief Financial Officer (CFO) at Lyft before transitioning to the role of Chief Business Officer, which closely aligns with typical CRO responsibilities. His strategic insights have been pivotal in driving Lyft’s revenue streams, especially during the company’s significant IPO phase.

While precise data for Brian Roberts is not publicly itemized, we can infer from Lyft’s proxy statements. As the Chief Financial Officer (CFO), prior to transitioning to Chief Business Officer, his total compensation was around $6 million per year, which includes salary, bonuses, and stock options.

- Marketo’s CRO (Before Adobe Acquisition)

Prior to its acquisition by Adobe, Marketo, a renowned marketing automation platform, had a strong leadership team with a highly compensated CRO

CRO drives revenue

playing a crucial role in its growth and eventual sale. During its independent phase, executives at Marketo, including the CRO, were well-compensated as part of the company’s growth strategy. Although specific CRO data is scarce, top-level executives in similar firms typically had compensations ranging from $500,000 to over $1 million annually, with additional stock and performance incentives.

- Jon Suarez-Davis – Salesforce

Jon Suarez-Davis held senior roles at Salesforce, including key positions that involved revenue generation strategies. Salesforce is known for compensating its top executives generously, reflecting their strategic importance in driving business success.

- Janet Heppner – Zoom Video Communications

As the VP of Revenue Operations (a role often overlapping with CRO functions) at Zoom, Janet Heppner has been integral in scaling Zoom’s phenomenal growth, particularly during global digital transformation and remote work surge periods.

- Scott Herren – Cisco

Scott Herren, the CFO of Cisco, also oversees revenue operations akin to CRO responsibilities. His total compensation in 2020 was approximately $12 million, primarily through a mix of base salary, bonuses, and equity grants.

These individuals exemplify the high caliber of talent and strategic thinking required of a top-tier CRO. Their expertise spans various industries, demonstrating how essential effective revenue leadership is in achieving substantial business growth.

Compensation for Chief Revenue Officers can vary widely depending on factors such as company size, industry, and location. However, the position is generally well-compensated due to its critical importance. According to recent salary surveys, the Chief Revenue Officer salary can range from $150,000 to over $400,000 annually, with top earners in large corporations or high-growth sectors commanding even higher packages. This often includes base salary, bonuses, stocks, and equity stakes, reflecting the significant impact a CRO can have on an organization’s success.

According to PayScale, the average total compensation for CROs at large public companies ranges between $200,000 to $600,000 annually. For tech giants and high-growth firms, this range often extends higher due to substantial stock options and performance bonuses.

For example, CROs at high-performing tech startups or public companies can see compensation levels as high as $1 million to $5 million per year, considering their critical role in driving revenue.

CROs at high-profile companies are compensated handsomely, reflecting their pivotal role in fostering growth and revenue optimization. By understanding these benchmarks, businesses can better appreciate the value brought by dedicated revenue leadership, whether full-time or a fractional CRO. But it certainly highlights the value one gets in having a fractional CRO which is significantly less than a full-time CRO.

What is the difference between a CRO and a CCO?

Understanding the distinctions between executive roles is vital for businesses to allocate responsibilities accurately. There’s often confusion around Chief Revenue Officer vs COO and Chief Revenue Officer vs Chief Commercial Officer.

Chief Revenue Officer vs COO:

While both the CRO and COO (Chief Operating Officer) are high-level executives, their roles are distinct. The COO focuses on optimizing day-to-day operations and ensuring the efficient functioning of the organization. In contrast, the CRO’s primary focus is on revenue generation and growth strategies, spanning sales, marketing, and customer success.

Chief Revenue Officer vs Chief Commercial Officer:

The CCO (Chief Commercial Officer) role is more specialized in developing and overseeing commercial strategies, including market expansion and pricing models. Meanwhile, the CRO has a broader mandate that encompasses all aspects of revenue across various departments, working to unify efforts towards boosting overall company revenue.

We’ve already addressed the key duties and job description of a Chief Revenue Officer. Let’s delve a bit further into the Chief Commercial Officer to better appreciate the differences.

A Chief Commercial Officer is more focused on creating and executing commercial strategies. This role often involves market analysis, product development, and pricing models to penetrate and expand in existing markets. The CCO aims to optimize the organization’s commercial performance, typically through external partnerships, market opportunities, and product commercialization.

CRO and CCO work in tandem

Key Responsibilities:

- Market Strategy: Develops and implements market entry and expansion plans.

- Product Development: Oversees the lifecycle of product development from ideation to market launch.

- Pricing Strategies: Defines pricing models and policies to maximize profitability and market competitiveness.

- Partnerships & Alliances: Establishes and nurtures strategic business relationships and alliances.

- Market Analysis: Conducts thorough market research to identify growth opportunities and competitive landscape.

Skills Required:

– Deep understanding of market dynamics and trends

– Innovation and product development expertise

– Strong negotiation and relationship management skills

– Commercial acumen to drive profitability

Key Differences:

- Scope of Responsibilities:

CRO: Focuses broadly on all aspects of revenue generation and alignment across sales, marketing, and customer success.

-CCO: Concentrates on commercial strategy, focusing on market penetration, product development, and pricing.

- Primary Objectives:

– CRO: To drive overall revenue growth by ensuring that sales, marketing, and customer success efforts are aligned and effective.

-CCO: To enhance commercial performance through strategic market positioning, effective product development, and optimized pricing strategies.

- Functional Integration:

CRO: Integrates multiple departments focused on revenue generation, requiring a holistic view of the company’s revenue mechanisms and how they interact.

CCO: More specialized in developing and executing go-to-market strategies and driving commercial success, without necessarily directly overseeing sales or customer success teams.

- Strategic Focus:

CRO: Develops long-term revenue strategies with a focus on growth metrics, KPIs, and return on investment (ROI) across the entire organization.

CCO: Creates action plans to maximize market share, innovate products, and ensure competitive pricing to support the broader business objectives.

- Decision-Making Influences:

CRO: Uses data analytics and performance metrics extensively to inform decisions and strategize revenue pathways.

CCO: Relies heavily on market research, consumer insights, and competitive analysis to shape commercialization strategies.

Here’s a real-world example:

Imagine a software company launching a new product suite:

– The CRO would oversee the overall revenue strategy, ensuring that the sales team is effectively pitching the product, the marketing team is generating demand and nurturing leads, and the customer success team is working to retain and upsell clients.

– The CCO, meanwhile, would be deeply involved in the product’s market introduction, determining optimal pricing strategies, crafting the commercial pitch, and identifying potential market segments and partnerships to penetrate.

By understanding these key differences, companies can better define each executive’s role and leverage their unique expertise to drive business

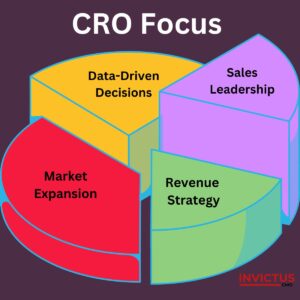

A CRO focuses on 4 key areas

success.

Did you know that “Research indicates that 47% of companies using fractional executives have experienced enhanced scalability and flexibility in their operations.”

Likewise, businesses utilizing fractional executives saw a 32% increase in efficiency and productivity within one year of implementation.

I’ll leave you to noodle on those facts as you consider going with a fractional CRO because you may not have the budget for a full-time CRO, but clearly, they are a vital component of any business’ thriving success!

If you’ve decided to get serious about your revenue generation, schedule your CEO Flash Focus meeting today—a preliminary focused and high-level 15-20-minute meeting to highlight the main challenges. No selling. Just solutions.