Fractional CFO at work

If you’re running a small to midsize business with annual revenues between $5 million and $50 million, you might be considering the benefits of hiring a Fractional CRO. But what about a fractional CFO? We started this series with an article entitled “What is a Chief Revenue Officer?” but now we shift our focus to the fractional CFO and how does a fractional CFO fit into your business strategy? Let’s dive into the costs and benefits of bringing a fractional CFO on board.

What Does a Fractional CFO Do?

Before we get into answering how much does a fractional CFO cost, let’s first answer the most basic question: What does a fractional CFO do to merit any expense. A fractional CFO provides high-level financial strategy, planning, and analysis without the full-time commitment or cost of a traditional CFO. They help with financial forecasting, budgeting, cash flow management, and even fundraising. Another important aspect that a GOOD fractional CFO will concern themselves with is sales and use tax compliance and unclaimed property compliance. Even acknowledging these two essentials will put them a cut above the rest. Essentially, they bring the expertise of a seasoned financial executive at a fraction of the cost.

How Much Does a Fractional CFO Make?

What does a fractional CFO do?

The compensation for a fractional CFO varies based on factors such as experience, industry, and the specific needs of your business. Generally, the fractional CFO hourly rate can range from $150 to $500 per hour. Some may prefer a retainer model or a fractional CFO contract that outlines specific deliverables and time commitments.

For instance, a small business might engage a fractional CFO for 10-20 hours per month, leading to a monthly cost of $1,500 to $10,000. This flexibility allows you to scale services up or down based on your business’s current needs and financial situation. By comparison, In September 2023, Investopedia reported that the median annual salary for a CFO in the United States was $433,088, with the bottom 25th percentile earning $328,098 and the 75th percentile earning $555,618.

How Much Does It Cost to Get a CFO?

As you can see by the numbers above, hiring a full-time CFO can be a significant investment, often costing between $150,000 on the lowest end to $550,000 annually on the higher end and that’s excluding bonuses and benefits. This cost can be prohibitive for many small to midsize businesses. However, the alternative—engaging a fractional CFO—provides access to high-level financial expertise without the full-time salary and benefits commitment. Remember, a fractional CFO comes with extensive background and successful work experience with a honed in level of expertise and leadership. They typically can hit the ground running whereas a new, full-time CFO takes some warm-up time.

A fractional CFO typically charges based on an hourly rate, a monthly retainer, or a project-based fee. This model ensures that you only pay for the services you need when you need them. For many businesses, this means getting top-tier financial advice and support at a fraction of the cost of a full-time hire.

Is a fractional CFO worth it?

Is a Fractional CFO Worth It?

You might be asking yourself if the investment in a fractional CFO is worth it. The answer largely depends on your business’s specific needs and financial situation. Fractional CFOs offer a range of fractional CFO services, including financial strategy, risk management, financial reporting, and assistance with mergers and acquisitions as well as sales and use tax compliance and related compliance issues. Fractional CFOs examine both current and historical financial data to deliver clear and precise information, enabling you to make informed, data-driven business decisions. A lack of compliance in any of the forementioned issues could bankrupt a company with the consequences. Plus, having solid financials makes your company worth more should you be searching for any investors.

These services can provide significant value by helping you make informed decisions, optimize cash flow, and prepare for growth. For businesses that don’t need a full-time CFO but still require high-level financial guidance, a fractional CFO can be an ideal solution.

In summary, the cost of hiring a fractional CFO can vary widely but generally provides a cost-effective way to access top-tier financial expertise. Whether you’re looking to manage cash flow more effectively, prepare for growth, or navigate complex financial landscapes, a fractional CFO can provide the strategic support you need without the full-time commitment not to mention the reputable image that you want to portray with your business.

If you’re considering whether a fractional CFO is right for your business, think about the specific financial challenges and opportunities you face. Then,

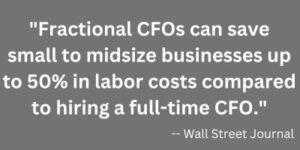

Fractional CFOs can save small to midsize business 50% on labor costs

weigh the potential benefits against the costs to make an informed decision.

Ready to explore how a fractional executive can help your business thrive? Contact us today to learn more about our fractional CMO or CRO services and how we can support your financial goals. Schedule your private CEO Flash Focus Call today. It’s a preliminary focused and high-level 15-20-minute meeting with CEOs to highlight the main challenges. No selling. Just solutions.