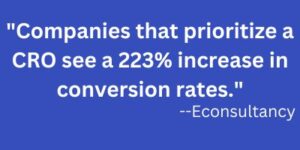

CROs bring a 223% customer conversion improvement

Today’s business world is relentless and unforgiving. No matter who you are or what your intentions are maximizing revenue is the name of the game. It doesn’t just make A difference, it makes ALL the difference. One crucial strategy for achieving this goal is through the implementation of Fractional CRO (Chief Revenue Officer). But exactly what is a Chief Revenue Officer, and why is it essential for businesses in the $5 million to $50 million revenue range? Let’s dive in to uncover the purpose and significance of the CRO in driving business growth and success.

What is the Purpose of a CRO?

You know how in today’s crazy business world, everyone’s scrambling to find ways to rake in more cash and outshine the competition? Some CEOs have a drive to thrive and expand rather than just survive and remain stagnant, even though profitable. Well, enter the unsung hero of revenue growth: the Chief Revenue Officer, aka the CRO. Picture this: the CRO is like the secret sauce that makes everything click. It’s all about fine-tuning different parts of a business to boost conversions. Think turning those random website visitors into loyal customers or transforming leads into cold, hard sales. Yep, that’s the magic of CRO in action. The CRO focuses on three areas. The CRO’s marketing focus, their focus on sales and their focus on customer success. A good CRO will lead all three of these teams successfully. Anything that has to do with revenue generation is under the purview of the Chief Revenue Office.

CRO guides through trends

What Does a Chief Revenue Officer Do?

A Chief Revenue Officer (CRO) is a crucial executive role responsible for driving revenue growth within a company. But what exactly does a CRO job description entail? Well, it varies depending on the organization and what type of CRO you have. There are essentially two types of CROs. There’s the CRO that’s heavy handed in the marketing side, and the one that’s acutely focused on the sales side of things. That’s not to say they don’t give time and expertise to the customer success, but they usually are hyper-focused on either marketing or sales. The CRO works with establishing and working with the tech stacks that will make the various departments work like a well-oiled machine and they work to make sure that the three revenue generating departments are on the same page, with a focus on the customer’s journey and their needs rather than features of the business or product/service. They also analyze market trends, identify growth opportunities, and develop strategies to capitalize on them. They will usually assist in identifying ways to enhance customer conversion, lead generation, and business development.

Another way that the types of CROs can vary is their talents on ai or the digital space with traditional CROs focused on sales and revenue, to digital CROs specializing in online marketing and e-commerce.

What is a CRO Job Title?

When it comes to job titles, “CRO” can sometimes be confusing, as it’s not limited to Chief Revenue Officers. In the medical field, CRO stands for Clinical Research Organization, which plays a vital role in conducting clinical trials and research studies. However, in the business realm, the focus is on the Chief Revenue Officer, the individual responsible for driving revenue growth and maximizing profitability.

Difference between CFO and CRO

What is the Difference Between a CRO and a CFO?

While both Chief Revenue Officers (CROs) and Chief Financial Officers (CFOs) play critical roles in a company’s financial success, their responsibilities differ significantly. A CRO is primarily focused on revenue generation and growth strategies, whereas a CFO is more concerned with financial planning, budgeting, and overall financial health. While their goals may align in some areas, such as increasing profitability, their day-to-day duties and areas of expertise are distinct.

The role of a Chief Revenue Officer (CRO) is paramount in today’s business landscape, especially for small to midsize companies aiming to scale and thrive. By understanding the purpose of a CRO, businesses can leverage their expertise to drive revenue growth, enhance customer satisfaction, and achieve sustainable success. Whether it’s optimizing conversion rates, leading sales teams, or identifying new market opportunities, the CRO plays a pivotal role in shaping the future of a company.

So, wrapping it all up, you can see how pivotal a Chief Revenue Officer (CRO) is in the grand scheme of things. But wait…what if you could have all the expertise and strategic brilliance of a CRO without the hefty price tag of a full-time executive? Typically a CRO is paid a hefty salary, equity in the firm bonuses and commissions. That’s where the concept of fractional CRO comes into play favorably because it’s like having a high-powered revenue wizard on your team, but only when you need them. With fractional CRO, you get all the benefits of seasoned revenue expertise without breaking the bank or giving away part of your company. In fact, the Wall Street Journal says that you can save up to 50% on labor costs with a fractional CRO. (Fractional CFOs can save small to midsize businesses up to 50% in labor costs compared to hiring a full-time CFO.” – The Wall Street Journal). So, if you’re ready to take your business to the next level and maximize your revenue potential, consider the game-changing advantages of bringing a fractional CRO on board. Trust me, your bottom line will thank you for it.

Your revenues are waiting so reach out to us today for your private CEO Flash Focus call with our expert CRO. It’s a preliminary focused and high-level 15-20-minute meeting with CEOs to highlight the main challenges. No selling. Just solutions.